By Joseph A. Bellinghieri, Esquire-

Opportunity Zones were added to the United States Tax Code by the Tax Cuts and Jobs Act on December 22, 2017. An Opportunity Zone is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by each state and that nomination has been certified by the Secretary of the U.S. Treasury.

Opportunity Zones were added to the United States Tax Code by the Tax Cuts and Jobs Act on December 22, 2017. An Opportunity Zone is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by each state and that nomination has been certified by the Secretary of the U.S. Treasury.

The purpose of an Opportunity Zone is economic development. The Government wanted to spur economic development and job creation in distressed communities. This is accomplished by providing tax benefits to investors in such distressed communities.

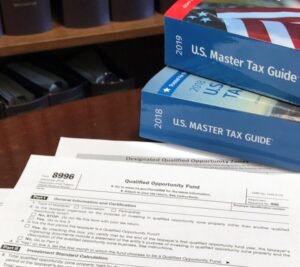

The tax benefit to investors is as follows: Investors can defer tax on any prior gains invested in a Qualified Opportunity Fund until the earlier of the date on which the investment in a Qualified Opportunity Fund is sold or exchanged or December 31, 2026. If the Qualified Opportunity Fund investment is held for longer than 5 years, there is a 10% exclusion on the deferred gain. If it is held for more than 7 years, the 10% becomes 15%. If the investor holds the investment in the opportunity fund for at least 10 years, the investor is eligible for an increase in basis of the Qualified Opportunity Fund investment equal to its fair market value on the date that the Qualified Opportunity Fund is sold or exchanged.

A Qualified Opportunity Fund is defined as an investment vehicle that is set up either as a partnership, corporation or LLC for investing in eligible property that is located in a Qualified Opportunity Zone. You do not need to live, work or have business in an Opportunity Zone. All you need to do is invest a recognized gain in a Qualified Opportunity Zone and elect to defer the tax on that gain.

There is a list of designated Qualified Opportunity Zones that can be found online, as well as at the Federal Register. To become a Qualified Opportunity Fund, an eligible corporation, partnership or LLC will self-certify by filing Form 8996, Qualified Opportunity Fund with its Federal Income Tax return. In order to qualify for the tax deferral, investment must be made within a 180-day period beginning on the date of the sale.

Joseph A. Bellinghieri represents individuals and businesses with a variety of estate, tax, real estate, and business issues.

Joseph A. Bellinghieri represents individuals and businesses with a variety of estate, tax, real estate, and business issues.

If you wish to discuss the impact of this new law on your situation, please contact Joseph A. Bellinghieri at (610) 840-0239 or [email protected].